Filing your Self Assessment doesn’t have to be a headache, especially when it comes to claiming back your business expenses. If you’re a sole trader, freelancer, landlord or even running a little side hustle, you can reduce your tax bill by claiming what’s known as allowable expenses.

In this post, we’ll walk you through what you can claim, how to fill it in on the Self Assessment form, and a few common slip-ups to avoid.

What are allowable expenses?

Let’s start simple. Allowable expenses are the costs you can deduct from your income before HMRC works out how much tax you owe. It’s their way of saying: “We get that running a business costs money.”

These expenses need to be “wholly and exclusively” for your work. In plain English: it’s got to be something you spent just for your business.

Common expenses you might be able to claim:

Office costs (like stationery, postage, printer ink)

Phone and internet bills (business portion only)

Travel costs (mileage, train fares, parking — not commuting)

Rent for business premises

Advertising and marketing

Subscriptions and memberships (if related to your work)

Insurance (business-related)

Accountancy fees (yes, even your Xero subscription)

If you work from home, you might be able to claim a portion of your bills too. More on that below.

How do you claim expenses on your Self Assessment?

Now for the practical bit. How do you actually enter these expenses into the Self Assessment tax return?

HMRC makes this fairly straightforward, especially if you’re using accounting software like Xero (highly recommended). But you can also do it manually if you’re still using spreadsheets or paper records.

If you’re a sole trader or freelancer

Log in to your HMRC online account.

Go to the Self Assessment section.

Choose ‘Self-employment (short or full)’ depending on your income.

You’ll see a section for ‘Allowable expenses’.

Enter your totals in the right boxes, like “Car, van and travel expenses”, “Office costs”, and so on.

Top tip: If your income is under £85,000 (as of 2025), you can use the short form, which means you only need to enter your total income and total expenses.

What if I work from home or use personal things for work?

Good question. Lots of people mix business and personal life, especially if you’re freelancing from your kitchen table.

Here are a few things to bear in mind.

Working from home

You can claim a flat rate based on hours worked per month, or a portion of your actual bills. That includes:

Rent (if you’re a tenant)

Gas and electricity

Council tax

Internet

Just be fair and consistent. If you use one room out of five for work, 20% might be reasonable. Keep it realistic, and don’t over-claim.

What you can’t claim

To stay on the right side of HMRC, it helps to know what doesn’t count as an allowable expense.

Here’s what you can’t claim:

Personal expenses (like clothes, unless it’s a uniform or protective gear)

Everyday commuting costs

Lunch on a normal workday (unless you’re travelling for business)

Client entertainment (sadly, dinner and drinks don’t count)

Keep good records (please!)

HMRC doesn’t ask for receipts with your return, but you must keep records in case they ever ask to see them.

Here’s what to keep:

Invoices and receipts

Bank statements

Mileage logs (apps like MileIQ make this super easy, and it links with Xero)

A clear record of how you worked out any personal vs business use

You should hold onto everything for at least six years after the 31 January deadline.

Want an easy way to stay on top of it all?

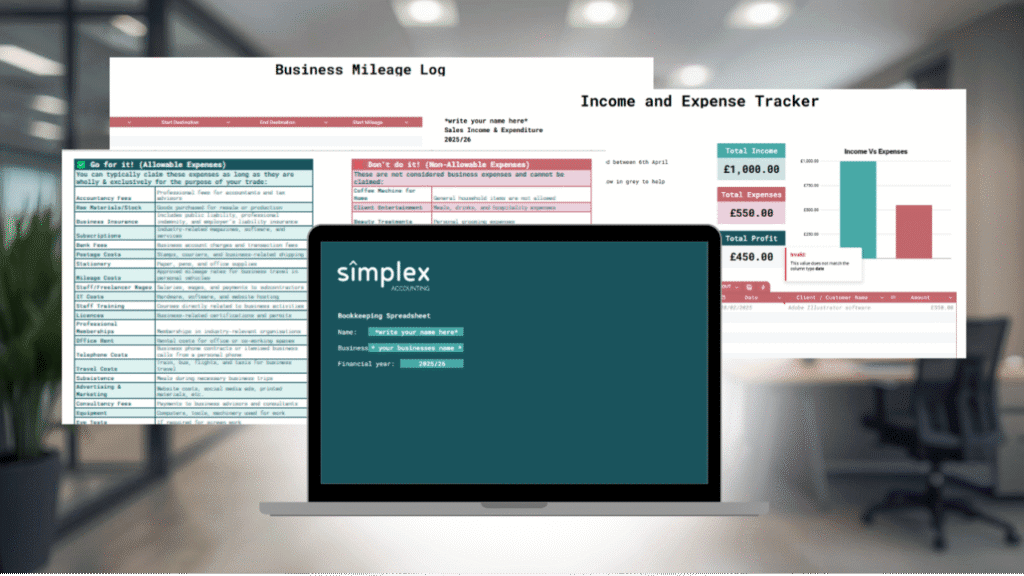

If spreadsheets are your thing, check out our All-In-One Bookkeeping Spreadsheet. It includes:

An income and expense tracker

A mileage log

An expense cheat sheet

And it’s designed for UK sole traders, freelancers and side hustlers

Final tips to make claiming easier

Let’s wrap up with a few tips to keep things stress-free when tax season rolls around.

Use accounting software like Xero. It tracks expenses as you go and makes Self Assessment much easier.

Don’t guess. Always base your claims on real numbers.

Ask an accountant if you’re unsure. The tax savings could more than cover the cost.

Start early. Avoid the January panic.

Need help with your Self Assessment?

If you’re feeling unsure about what you can claim or just want someone to talk it through with, you’re not alone.

Book a free 30-minute call with me and let’s make sure you’re on the right track with your Self Assessment and expenses.

Comments are closed