Feeling stuck? Here’s how to take control of your cash flow, increase your profits, and move your business from just surviving to thriving.

Running your own business is exciting, but it can also feel like a never-ending cycle of stress. If you’re constantly worrying about covering bills, chasing invoices, or dreading the next HMRC deadline, you’re probably in survival mode.

But here’s the truth: survival mode isn’t a permanent place. With the right steps, you can get back in the driver’s seat and start building a business that works for you, not the other way around.

Let’s walk through six smart ways to move from surviving to thriving.

Understand Why You’re in Survival Mode

You can’t fix what you don’t face. Before diving into action, take a step back and look honestly at what’s really going on in your business.

Grab a cuppa and sit down with your numbers. Ask yourself:

Are my overheads creeping up without me noticing?

Do I have consistent cash coming in, or is it feast or famine?

Am I chasing late payments every month?

Do I know how much tax I owe – or am I guessing?

Many business owners find themselves in survival mode simply because they don’t have a clear view of their financials. That’s not a failure – it’s incredibly common. But it’s also fixable.

📌 Tip: A basic cash flow forecast can give you immediate clarity. You don’t need fancy software to start – a simple spreadsheet will do. Or use a free tool or template that links to your Xero account to get an even clearer picture.

Get Ruthless With Cash Flow

Here’s the harsh truth: most small businesses don’t fail because of a lack of customers. They fail because they run out of cash.

If cash flow is your weak point, it’s time to get proactive. That means:

Invoicing as soon as possible. Don’t wait till the end of the month.

Chasing payments without guilt. You’re not being rude – you’re protecting your business.

Offering early payment discounts (or charging late fees if allowed under your contract).

Negotiating with suppliers for longer terms or bulk discounts.

Cutting the fluff. That £40/month tool you barely use? Cancel it. Weekly team takeaways? Switch to once a month.

🎯 Your goal should be to build up a cash buffer – ideally, 1 to 3 months of operating expenses. This gives you room to breathe when sales dip or unexpected bills land.

💡 Xero Insight: If you’re using Xero, their cash flow dashboard lets you spot trends and shortfalls before they become emergencies. It’s a game-changer.

If cash flow is a struggle, your invoicing process might be part of the problem. Don’t worry – we’ve made it easy to fix.

Our FREE Invoicing Guide is packed with practical tips to help you:

Send professional, HMRC-compliant invoices

Avoid common delays and late payments

Speed up your payment process with simple tools

Stay organised (without faffing around in spreadsheets)

Whether you’re just starting out or want to tighten up your system, this guide gives you clear, no-fluff advice you can use right away – including a handy PDF you can keep for reference.

👉 Download the guide here and start getting paid quicker – with less chasing and more confidence.

Flip Your Finances With ‘Profit First’

Most business owners follow the formula:

Income – Expenses = Profit.

But in practice, that often leaves nothing left over.

That’s where the Profit First method comes in. It flips the equation:

Income – Profit = Expenses.

Every time money comes in, you immediately divide it into separate “pots”:

Profit (yes, even a small percentage to start)

Tax (to avoid that horrible “how much?!” moment in January)

Owner’s Pay (you deserve to be paid properly!)

Operating Costs (what’s left is what you run the business on)

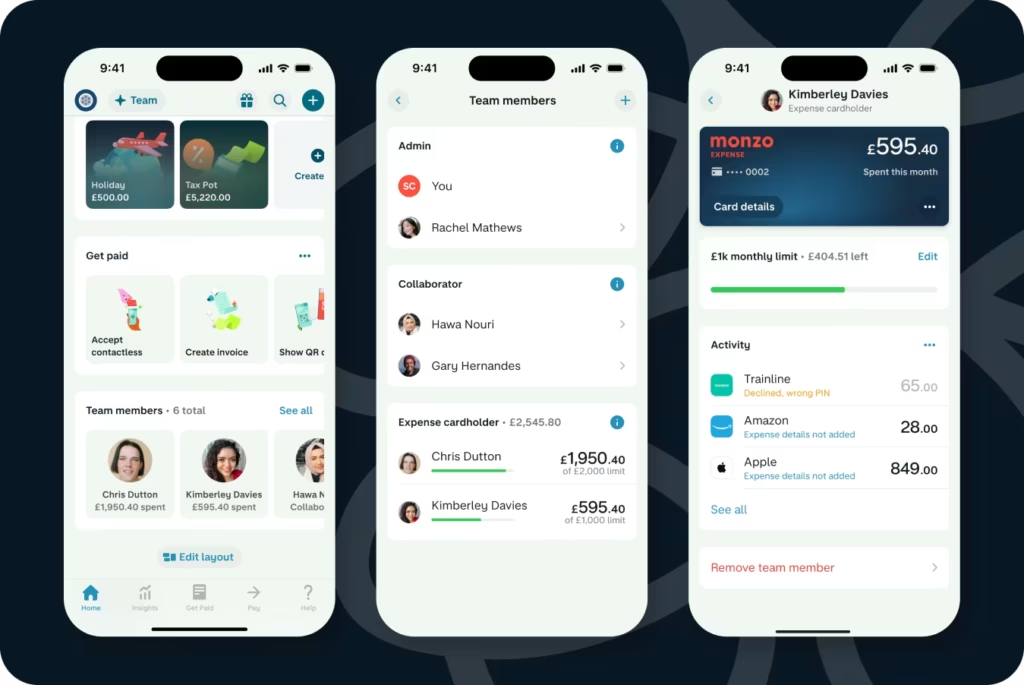

💡 Use bank accounts or sub-accounts with Starling, Monzo Business, or any high-street bank to keep these pots separate. You’ll be less tempted to “borrow” from the tax pot when things feel tight.

Bonus Tip: Make Profit First Easier With Monzo

If you like the sound of the Profit First method but dread the idea of juggling multiple bank accounts, we’ve got a shortcut for you.

Monzo Business Pro lets you set up labelled “pots” inside one account – perfect for separating your tax, profit, and expenses without opening loads of accounts.

And here’s the even better part:

🎁 Sign up to Monzo Business using this link (affiliate) and you’ll get:

£50 deposited straight into your account, and

Six months of Xero for free when you pick the Pro plan

It’s a great way to test out Profit First and get your accounting tools sorted in one go.

We love Monzo because it’s designed for small businesses – fast, clear, and fully compatible with Xero.

Affiliate note: We may earn a small referral fee if you sign up via this link – but we only ever recommend tools we trust and use ourselves.

Make Your Offers More Profitable

Are you run ragged, booked out weeks in advance – but still barely making ends meet?

That’s a big sign your pricing or packages need a rethink.

Ask yourself:

Are my rates covering ALL my costs – including tax, time, and overheads?

Do I offer any high-value packages or retainers?

Am I holding onto low-profit clients or services out of habit or fear?

It’s easy to think “more work = more money,” but that’s only true if the work is actually profitable. It might be time to raise your prices, stop offering unprofitable services, or focus on fewer, more lucrative projects.

✅ Quick Profit Check: If you charge £150 for something that takes 4 hours and you spend another 2 hours on admin, that’s £25/hour before tax. Is that sustainable?

📈 Try creating value-packed bundles that are easier to sell and more rewarding to deliver.

Build in Breathing Room

Survival mode feels like: “If I stop, the business stops.”

But if that’s true – your business isn’t sustainable. You’re not a machine.

Once you’ve stabilised your cash flow and sorted your pricing, it’s time to build breathing space into your week.

Here’s how:

Automate anything repetitive – like invoice reminders or payroll. Xero can handle loads of this with built-in automations and partner apps.

Outsource low-value tasks – think bookkeeping, admin, even email management.

Block out non-negotiable CEO time – every week, even just an hour. Use this time to think, plan, and review, not do.

🧠 Your energy, ideas and focus are your most valuable business assets. Protect them.

Get the Right Support

Trying to do it all yourself? That’s often what keeps small businesses stuck. And when it comes to finances, guesswork only gets you so far.

👋 At Simplex, we’re not just here for year-end paperwork. We’re your financial wingperson – helping you shift from reactive to confident, one smart step at a time.

Here’s how we help:

Spot money leaks and improve your margins

Set up systems that prevent surprise tax bills

Plan for growth that’s profitable and sustainable

We know that if you’re in survival mode, hiring an accountant might feel like a luxury. But here’s the truth:

We’re not a cost – we’re an investment.

Most of our clients say they make back our fee within a few months – thanks to better pricing, clearer cash flow, and smarter planning.

🙌 No judgement. Just practical support to help you take control and move forward with confidence.

You’re Not Meant to Just Survive

Being in survival mode doesn’t mean you’re failing. It means your business is asking for something different – clearer systems, better pricing, smarter support.

With a few focused steps, you can shift from surviving to thriving.

✨ Ready to take back control?

Book a free discovery call with Simplex and let’s get your business working for you – not the other way round.

Comments are closed