When you’re starting out, a bookkeeper is a smart first hire. They log your income, track your expenses, and help with the basics like invoices and bank reconciliation.

But as your business grows, the financial side gets more complex, and you’ll soon find that basic bookkeeping just isn’t enough.

If you’re serious about growing, saving on tax, and planning for the future, you need more than tidy records. You need someone to help you use those numbers to make better decisions.

Bookkeeper vs Financial Partner: What’s the Real Difference?

Let’s keep it simple. A bookkeeper helps you stay on top of the past: logging what you’ve spent, what’s come in, and keeping everything tidy for your accountant.

But a financial partner (like us) helps you plan what’s next. We dig into the numbers with you, look at where the business is heading, and help you make smarter decisions along the way.

Here’s how the roles compare:

A bookkeeper tracks what already happened. We help you plan for what’s coming.

A bookkeeper gives you data. We help you actually understand it.

A bookkeeper works behind the scenes. We work alongside you.

A bookkeeper keeps the records tidy. We help you grow your business profitably.

In short, a bookkeeper records the past. We help you shape the future.

3 Signs You’ve Outgrown Your Bookkeeper

Here’s how to tell if it’s time to upgrade your financial support.

1. You don’t know how much profit you’re actually making

If you can’t answer “How much did I earn last month?” without digging through spreadsheets, your setup isn’t giving you what you need.

Take action: Ask for monthly management reports. Or chat to us about setting up real-time dashboards in Xero.

2. You’re always behind on tax planning

Leaving tax until January often means missed savings and last-minute stress.

Take action: Start doing tax planning every quarter. We help clients forecast their tax bills and spot reliefs early, like R&D claims, capital allowances, and business expenses you might be missing.

3. You want to grow but don’t have a financial plan

Thinking about hiring, launching a new product, or moving into a new space? Your bookkeeper won’t help you plan for the financial impact.

Take action: Build a 12-month cash flow forecast in Xero. Or ask us to guide you through one before making any big decisions.

The Extra Support Your Business Has Been Missing

Most bookkeepers give you tidy records and nothing more. That works when your business is small, but as you grow, you need more than organised numbers.

You need someone who understands the full picture. Someone who helps you turn financial data into clear direction for your business.

That is where we come in.

We are not here to drop off a report once a year or throw around jargon. We work with you all year round to make your business stronger and more profitable.

Here is what that means in practice:

We explain your numbers clearly

You will always know what is happening with your cash flow, profit, and tax. No more guesswork.We help you plan ahead

Thinking about hiring, launching something new, or growing your team? We help you plan the finances so you can move forward with confidence.We stay in touch all year

You will get regular check-ins and real, practical support whenever you need it.

In simple terms, we help you move from just keeping up to feeling in control. That is when real growth starts to happen.

Why We Use Xero (And Why It Works)

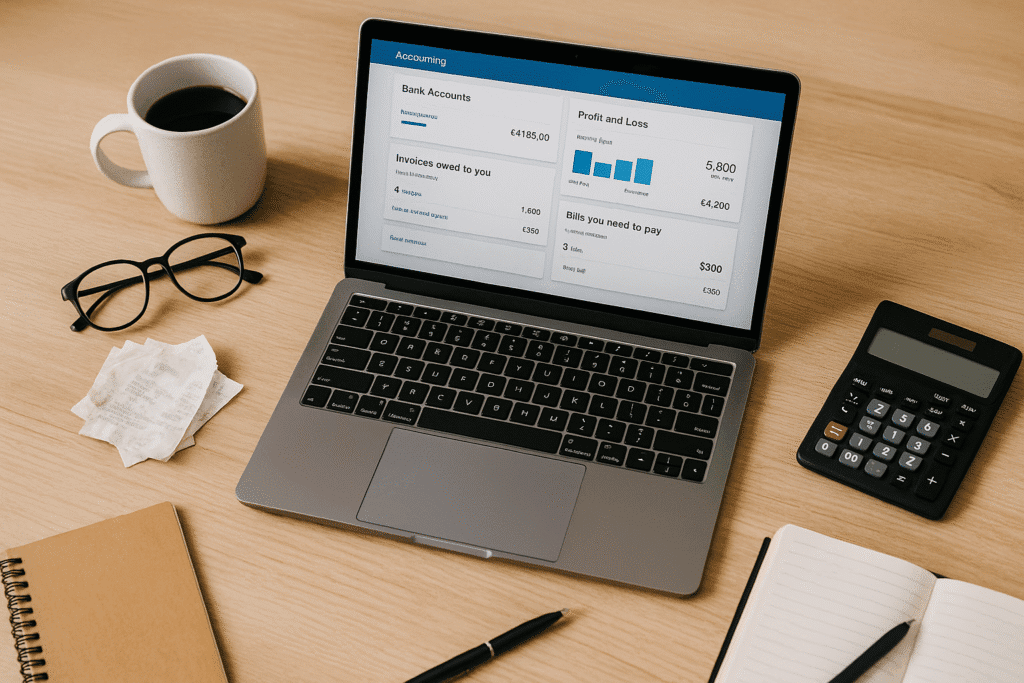

We use Xero because it makes managing your business finances simpler. It brings all your numbers together and shows you exactly how things are going in real time. You can check your invoices, track what you are spending, and see what tax is due, all from your phone or laptop.

It also takes the stress out of jobs like sending invoices, sorting payroll, and keeping up with VAT. Everything is in one place, easy to use, and built for small businesses. Xero also works with trusted apps that can help with cash flow, expenses, and day to day admin.

We will set it up properly, walk you through how to use it, and support you as your business grows. If you are not using Xero yet, or if it feels like you are not getting much out of it, we are here to help you get started.

Ready to Take the Next Step?

If you’ve outgrown basic bookkeeping, we would love to help.

We combine the right tools with real financial insight so you can run your business with less stress and more confidence.

Let’s have a chat about what you need and how we can help.

Comments are closed